Charitable giving isn’t just about generosity—it’s a powerful way to amplify your impact on the world while enhancing your financial future. Strategic charitable wealth planning allows you to align your financial goals with your values, ensuring that your contributions create lasting change for the causes that matter most to you. But how can you make sure your charitable giving is as effective and tax-efficient as possible? That’s where CNO Charitable Wealth Planning comes in.

In this article, we’ll explore the powerful tools and strategies CNO offers to help individuals and businesses optimize their wealth through philanthropy. By the end, you’ll understand how CNO Charitable Wealth Planning can transform the way you approach giving and help you create a legacy that lasts.

What is CNO Charitable Wealth Planning?

Definition

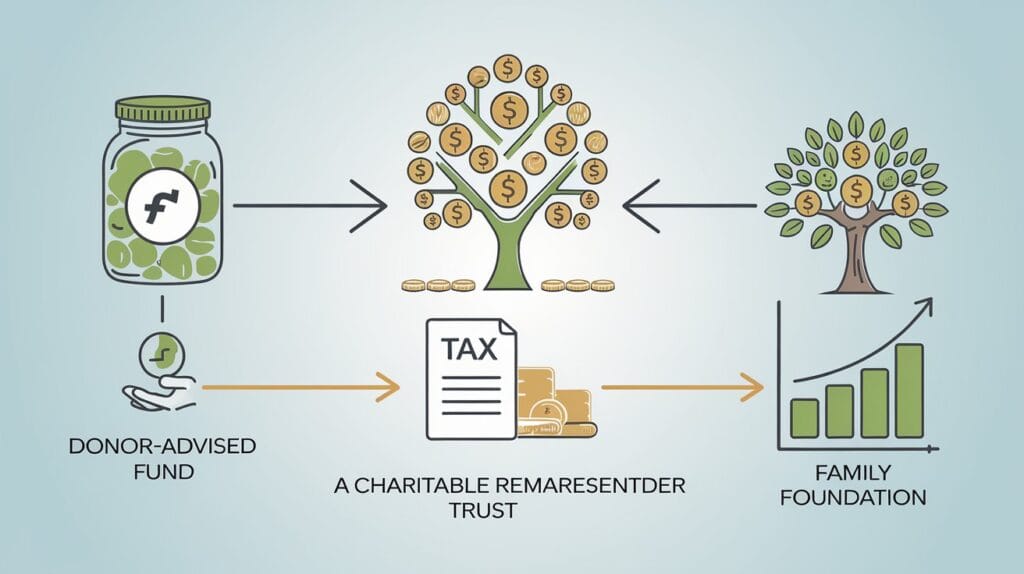

CNO Charitable Wealth Planning is a comprehensive approach to incorporating philanthropy into your financial strategy. It combines tools like Donor-Advised Funds (DAFs), charitable trusts and family foundations to help you maximize the impact of your donations while benefiting from tax advantages. Whether you are an individual or a corporation, CNO provides the expertise and strategies to ensure your charitable goals are met with efficiency.

How It Works

The process begins with identifying your charitable goals and then using tailored tools that suit your needs. For example, Donor-Advised Funds allow you to contribute to a fund and then direct those funds to your chosen charities over time. Charitable Remainder Trusts (CRTs) let you donate assets while continuing to receive income for the rest of your life. Family Foundations help you build a lasting legacy of giving for future generations.

Why It’s Important

Integrating philanthropy into your financial plan not only supports meaningful causes but also offers personal and financial benefits. By strategically planning your charitable donations, you can reduce taxes, create an income stream, and ensure that your contributions continue to make a difference long into the future.

Key Features and Benefits of CNO Charitable Wealth Planning

Personalized Strategies

CNO understands that every donor is unique. That’s why they offer personalized planning, tailoring strategies to meet your specific financial and philanthropic goals. Whether you’re an individual looking to leave a personal legacy or a business aiming to enhance corporate social responsibility, CNO creates a plan that aligns with your values.

Tax Optimization

One of the greatest advantages of CNO Charitable Wealth Planning is the ability to optimize your tax situation. By donating appreciated assets like real estate or stocks, you can avoid paying capital gains taxes. Additionally, charitable contributions provide tax deductions that reduce your overall taxable income.

Legacy Building

CNO’s wealth planning tools help you create a lasting legacy. Whether it’s through DAFs, charitable trusts, or family foundations, CNO ensures that your charitable efforts continue to have an impact, long after your lifetime. This ensures that your wealth serves a greater purpose—supporting communities and causes in perpetuity.

Diverse Tools

CNO offers a wide variety of tools to meet your charitable goals. From DAFs to charitable trusts and family foundations, these tools offer flexibility and control over your giving. Each tool has distinct advantages, allowing you to choose the one that best fits your financial and philanthropic objectives.

Flexibility and Control

CNO’s charitable wealth planning tools give you the flexibility to retain control over your giving.

For example: with DAFs, you can recommend grants to different charities at your own pace, giving you the ability to stay involved and ensure your donations align with your ever-evolving goals.

The Role of Tax Efficiency in Charitable Wealth Planning

Immediate Tax Deductions

One of the primary benefits of charitable giving is the immediate tax deduction it provides. When you donate to qualified charities, your contribution reduces your taxable income, which can significantly lower your overall tax burden.

Capital Gains Tax Avoidance

By donating appreciated assets, such as stocks or real estate, you can avoid paying capital gains taxes. This is especially beneficial for high-net-worth individuals who have large, appreciated assets that may be subject to heavy taxation.

Estate Tax Mitigation

Charitable giving can also play a key role in reducing estate taxes. By making charitable contributions during your lifetime or through bequests, you can lower the taxable value of your estate, ensuring more wealth passes on to your heirs.

Real-Life Examples

Imagine you have $1 million in stock that has appreciated over the years. By donating these stocks directly to a charity, you avoid paying capital gains taxes and receive a charitable deduction, potentially reducing your income taxes for the year. This is just one example of how tax efficiency can work for you when you plan your charitable giving strategically.

Tools for Charitable Wealth Planning?: Which One is Right for You?

CNO offers several tools for charitable wealth planning, each with its unique benefits. Here’s an overview of the most popular options:

Donor-Advised Funds (DAFs)

DAFs are a flexible and easy-to-manage tool for charitable giving. Once you contribute to a DAF, you can recommend grants to charities at any time, giving you control over how and when your funds are distributed. DAFs are ideal for donors who want to give strategically over time.

Charitable Remainder Trusts (CRTs)

A CRT allows you to donate assets while receiving income for a set period. After the term ends, the remaining assets go to charity. This is a great option for those who wish to continue receiving income from their assets while supporting charitable causes.

Charitable Lead Trusts (CLTs)

CLTs work in the opposite way from CRTs. The charity receives income from the trust for a specified period, and once that period ends, the remaining assets are passed on to your heirs. CLTs are an excellent way to reduce estate taxes while benefiting both charity and your family.

Family Foundations

Family foundations allow you to manage your charitable giving for generations to come. With this option, you can involve your family in philanthropic decision-making, ensuring that charitable giving becomes a family tradition.

Comparison Chart

| Tool | Best For | Key Benefit |

|---|---|---|

| DAFs | Donors who want flexibility and control | Ongoing charitable giving over time |

| CRTs | Those looking for income while donating | Income stream while giving to charity |

| CLTs | Those reducing estate taxes while supporting charity | Estate tax mitigation |

| Family Foundations | Families wishing to create a multi-generational legacy | Long-term, organized giving |

How to Build a Plan with CNO Charitable Wealth Planning?

Assessing Your Financial Situation

Before you begin your charitable giving, it’s essential to assess your financial situation. Understanding your assets, liabilities, and income sources ensures that your giving strategy is both realistic and impactful.

Setting Goals

Clear, measurable goals are key to a successful charitable wealth plan. Whether you want to donate a certain percentage of your income or support specific causes, setting goals will help you stay focused and ensure your charitable efforts align with your overall financial objectives.

Choosing the Right Tool

With CNO’s guidance, you can select the best charitable tool for your situation. Depending on your needs—whether it’s flexibility, tax benefits, or legacy creation—you can choose from DAFs, CRTs, CLTs, or family foundations.

Monitoring and Adjusting Your Plan

Your charitable wealth plan should evolve with your financial situation. Regular reviews and adjustments ensure that your strategy remains effective and aligned with both your financial goals and philanthropic intentions.

The Benefits of Working with Professionals

Expert Guidance

Charitable wealth planning can be complex. Working with financial advisors, estate planners, and tax professionals ensures that your strategy is optimized for tax benefits, long-term impact, and efficiency.

Custom Solutions

CNO’s professionals work with you to create custom solutions tailored to your financial situation and charitable goals. They ensure your plan is not only impactful but also tax-efficient and aligned with your values.

Case Studies: How CNO Charitable Wealth Planning Helps Real Clients

Client Success Stories

CNO Charitable Wealth Planning has helped countless individuals and businesses create lasting legacies of giving. For example, a family business used a DAF to fund scholarships, providing financial support to students for generations.

Before and After

Before working with CNO, many clients were unsure how to make their charitable giving both impactful and tax-efficient. After implementing CNO’s strategies, they were able to support their chosen causes while reaping tax benefits and creating a lasting impact.

How CNO Charitable Wealth Planning Builds Lasting Legacies

Long-Term Impact

CNO’s wealth planning tools ensure that your charitable contributions have a lasting effect. Whether you’re supporting education, healthcare, or the environment, your giving will continue to make an impact for generations.

Involving Future Generations

CNO encourages family involvement in charitable giving, helping to pass down philanthropic values to future generations and ensuring that your legacy continues.

How to Get Started with CNO Charitable Wealth Planning

Step-by-Step Guide

Getting started with CNO Charitable Wealth Planning is easy. Begin by assessing your financial situation, setting goals, and contacting CNO for a consultation. They will guide you through each step, helping you design a personalized giving plan.

Free Consultation Offer

CNO offers a free consultation to help you start your charitable wealth planning journey. Contact them today to learn more and begin transforming your charitable giving strategy.

Conclusion

Incorporating charitable giving into your wealth planning not only benefits the causes you care about but also offers significant tax advantages and the chance to leave a lasting legacy. With CNO Charitable Wealth Planning, you can take control of your giving and ensure that your impact lasts for generations.

Start your journey today and see how you can transform your philanthropic strategy with CNO.

FAQs

There is no specific minimum donation amount required to start with CNO Charitable Wealth Planning. However, the recommended amount may vary depending on the type of charitable vehicle you choose, such as a Donor-Advised Fund or a Charitable Remainder Trust.

Yes, CNO Charitable Wealth Planning offers flexibility, allowing you to adjust your charitable goals and giving strategy as your financial situation or philanthropic priorities evolve.

While creating a family foundation typically requires an initial contribution, the amount needed can vary depending on the foundation’s structure and your long-term goals. CNO will help you determine the best approach based on your needs.

Yes, there are fees associated with managing charitable vehicles like Donor-Advised Funds or Trusts. These fees typically cover administrative costs and are discussed upfront during the planning process to ensure full transparency.